Why Did Michael Burry Buy Banks?

I have spent a considerable amount of time reading old Michael Burry investment writeups along with Scion Asset Management letters. It is clear from his writing and analysis that Burry is a dye in the wool value investor. Burry buys off the beaten path stocks, doesn’t like to lose money and considers a “margin of safety” to be the most important topic that serious investors should abide by.

Given this backdrop and the nature of Burry to be a contrarian individual, his recent purchase of bank stocks makes sense. If you have been following our newsletter, we made a prediction that Burry would be loading up on regional banks the next time he filed his 13F for Scion Asset Management.

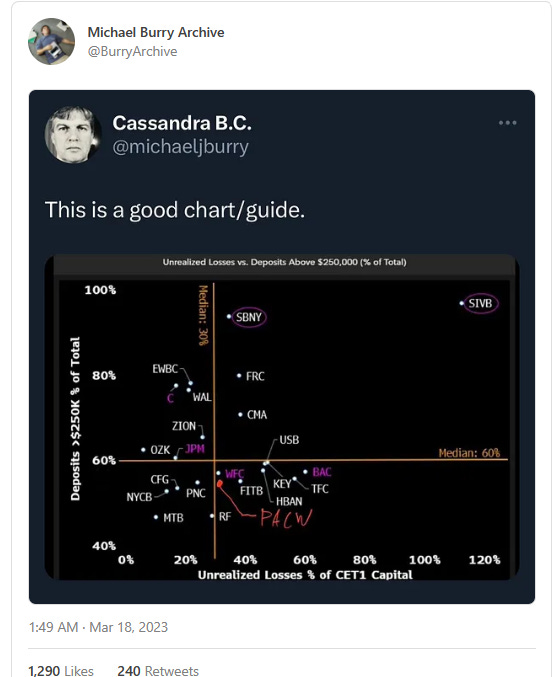

And if you follow Burry’s twitter feed, he was indicating that his time was spent on analyzing bank stocks. Here is what Burry posted on March 18th, 2023….

One day later bank stocks crashed, and Burry posted the following tweet…

The question remains, why would Burry be buying bank stocks?

We analyzed Burry’s decision to buy bank stocks below. Hopefully this analysis will free up some confusion we have been seeing on Twitter of people not understanding why Burry would be buying banks.

It appears to us that most people see Burry as “The Big Short” guy. The guy who successfully shorted the housing market. Most don’t know or see Burry as a successful value investor who focuses on deep value, out of favor equities.

This analysis on Burry’s bank buys should help clarify why Burry bought banks and why the entire financial industry remains one of the most interesting sectors to allocate capital to.

Keep reading with a 7-day free trial

Subscribe to Trade Trackers to keep reading this post and get 7 days of free access to the full post archives.