New Pelosi Buy Alert 🚨 Bought $1M of Apple

Exercised call options from1 year ago

The queen of Politician stock trading is back and better than ever. Earlier this morning Nancy Pelosi disclosed buying $1,000,000 of AAPL 0.00%↑ by exercising her LEAP call options she purchased back on 5/13/2022, which were up 12% while the market was only up 1%.

Coincidentally, of course, this trade came out the Friday before Easter Weekend & on a day when the stock market is closed. We will be writing up a formal post for our paid subscribers on the new Apple purchase next week, but below please find general info on the trade.

Official Trade: Exercised 100 AAPL 0.00%↑ call options by purchasing 10,000 shares with a strike price of $80/share for ~$1,000,000.

For those unfamiliar with how LEAP call options work, a LEAP is a type of call option that has a longer expiration date than a traditional call option. "LEAP" stands for "Long-term Equity Anticipation Securities", and these options can have expiration dates that are a year or more in the future. Because of their longer expiration date, LEAP options typically have a higher premium than traditional options. They can be used as a way to make a long-term bet on a stock or other underlying asset, giving the buyer more time for the stock price to increase before the option expires.

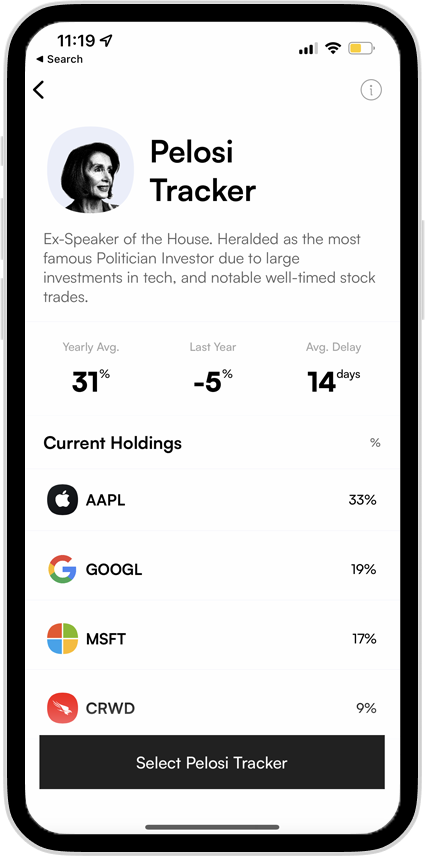

Pelosi is no stranger to Apple either. It has been her largest portfolio holding for months.

History of buying & selling Apple:

12/22/20 - Bought ~$500K at $131/share

5/21/21 - Bought ~$250K at $125/share

1/21/22 - Bought ~$1M at $162/share

5/13/22 - Bought ~$1M at $147/share

5/24/22 - Bought ~$500K at $137/share

6/17/22 - Sold ~$250K at $131/share

3/17/23 - Bought ~$1M at $155/share

Like we mentioned above, we will be doing a formal write up on this next week. I just wanted to share a quick summary for everyone as the trade came in moments ago.

Happy Friday!

Chris - Co founder of Autopilot

How long does it take for one of these inside trades to make it to your app ? Like when she sells . Before the price drops?