New Burry Buy Alerts 🚨

Good afternoon. Busy day is about to get busier.

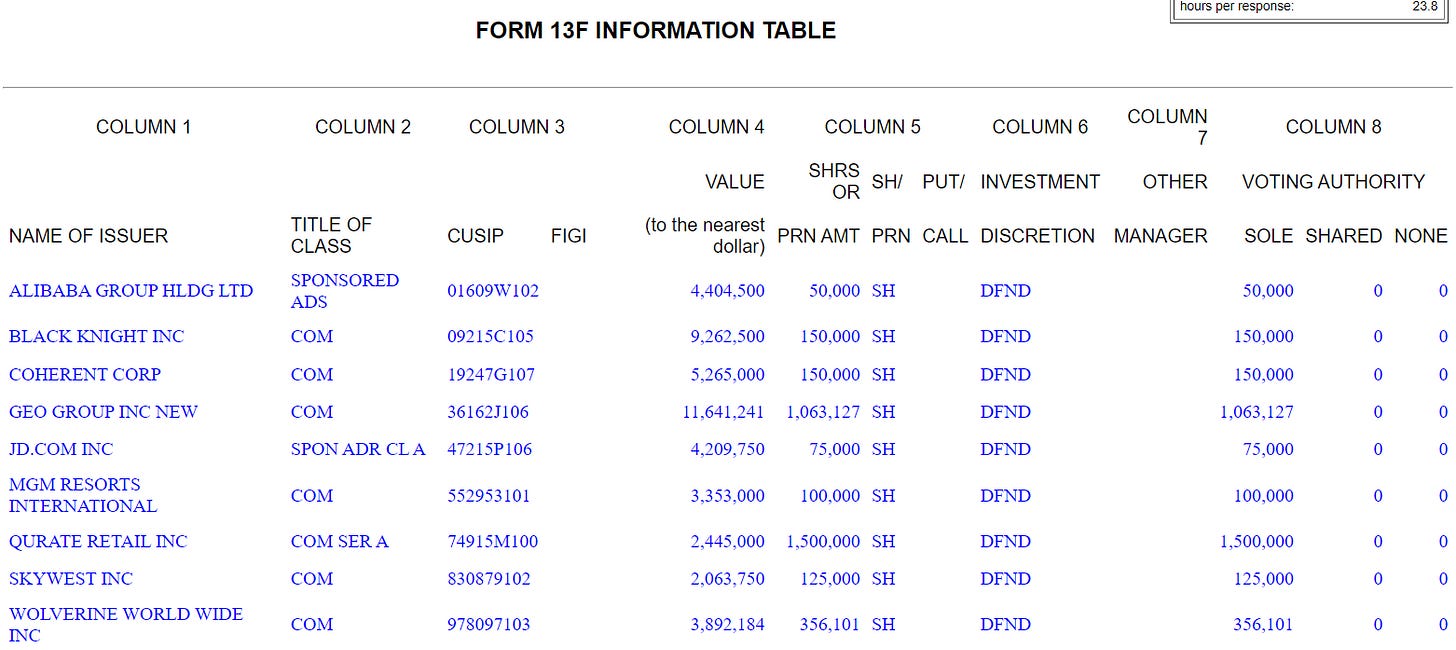

Michael Burry just filed his amended 13F holding for Scion Asset Management. Here are the most recent holdings.

New buys include Black Knight (BKI), Coherent Corp (COHR), Alibaba (BABA), JD.com (JD), Wolverine Worldwide (WWW) and Skywest Inc. (SKYW). Sells include The Geo Group (GEO), Qurate Retail (QRTEA, Aeroject Rocketdyne (AJRD), CoreCivic (CXW), Charter Communications (CHTR) and Liberty Latin America (LILAK).

Burry’s current portfolio is weighted as follows:

The largest company in his portfolio still is Geo Group. GEO 0.00%↑ We wrote up Geo Group here and explain the thesis. The company reported earnings today and the stock is off around 20% based on lower expectations for their Electronic Monitoring segment. We are still positive on the name and will be writing and update for paid subscribers this week.

Black Knight BKI 0.00%↑ is a new name to the Burry portfolio. Black Knight is currently in the process of selling its Empower loan origination software business so it can get compliance to sell the entire business to InterContinental Exchange (ICE) for $13 billion. Black Knight has a value of $10 billion. This is a merger arb play and likely has low risk of absolute downside and a meaningful IRR in the near-term for Burry.

Coherent Corp. COHR 0.00%↑ is a semiconductor and electronic company that has sold off recently. My best guess is the valuation is just too low (P/E of 11.0x) and Burry sees this as a mean reversion play. Over the next couple of weeks we will be digging into this name to see what kind of hidden assets Burry might see that the rest of the market doesn’t.

Alibaba BABA 0.00%↑ is a beaten down Chinese tech company that has been called the Amazon of China. Legendary investor Charlie Munger has been purchasing Alibaba for The Daily Journal’s portfolio. If you don’t think the Chinese government will steal the assets from outside shareholders, it likely has tremendous value and strong upside.

JD.com JD 0.00%↑ is another battered down Chinese tech company. Chinese tech stocks have fallen recently from the tension with the US and China over the spy balloons. It is likely these tensions are short-term in nature and Burry is using this opportunity to buy Chinese tech companies for a mean reversion play.

Wolverine World Wide WWW 0.00%↑ is a beaten down retailer in the United States that primarily sells footwear and apparel. The stock is cheap with a P/E ratio of only 7.0x and tailwinds incoming from lower freight costs and working capital monetization into 2023. We are pretty bullish on retailers in general as working capital will be monetized and turned to cash in 2023, making the enterprise value of these companies even cheaper on a forward basis.

MGM Resorts MGM 0.00%↑ is a casino and resort management company that is well known in value investing circles. The stock took a hit recently in December (likely from tax loss selling) and we are guessing Burry loaded up on the equity then. Since the tax loss selling the stock is up meaningfully. At the current valuation it looks fairly valued and we are guessing Burry has exited the name already.

We have provided detailed writeups on Qurate Retail for paying subscriber (please see here). Burry has trimmed the position as the stock has ran up in value quite rapidly over the past month. The stock is still very attractive from a valuation perspective as we personally hold the name in our portfolio. Upside here is meaningful if the management team can turn the company around.

The final company in Burry’s portfolio is SkyWest Inc. SKYW 0.00%↑ a beaten down regional airplane company near a 52 week low. In fact, the stock is at a multi-decade low and looks like a great value name to add to your portfolio. We will be spending some time on this name and putting out a detailed writeup on the investment thesis in the coming weeks.

For our paid community, expect detailed writeups on these names next few day as we dig into the thesis and investment opportunities. After this post, our prices will be increasing from $6.99 to $8.99 per month and $69.99 to $79.99 per year. Get in now and you will be grandfathered into the lower pricing 🤝

Happy Tuesday Fam!

I like the SkyWest investment. Their debt level is very high, but they are well positioned to benefit from the recent increase in travel.

They also own a lot of part/engines for their fleet of jets. Those could be much more valuable in the current environment.