Michael Burry just bought new stocks 🚨

Good evening. Sorry for the delay on this, but the busy week just got a whole lot busier.

Michael Burry, one of the most popular stock picking mangers, just filed hiss amended 13F holdings for Scion Asset Management. Here are the most recent holdings.

TLDR: He still loves Chinese stocks & bought the dip on the banks.

Brand new positions include SIG 0.00%↑ Signet Jewlers, New York Community Bank NYCB 0.00%↑, Zoom Info ZM 0.00%↑ , Capital One COF 0.00%↑ , Sibanye Stillwater SSW 0.00%↑ , Liberty Latin America LILAK 0.00%↑ , Cigna CI 0.00%↑ , Wells Fargo WFC 0.00%↑ , Western Alliance Bank WAL 0.00%↑ , Coterra CTRA 0.00%↑ , Nov Inc NOV 0.00%↑ , Devon Energy DVN 0.00%↑ , PacWest Bank PACW 0.00%↑ , and Huntington Bank HBAN 0.00%↑

Sells include MGM Resorts MGM 0.00%↑ , Skywest Inc SKYW 0.00%↑ , Wolverine World Wide WWW 0.00%↑ , & Qurate Retail QRTEA 0.00%↑

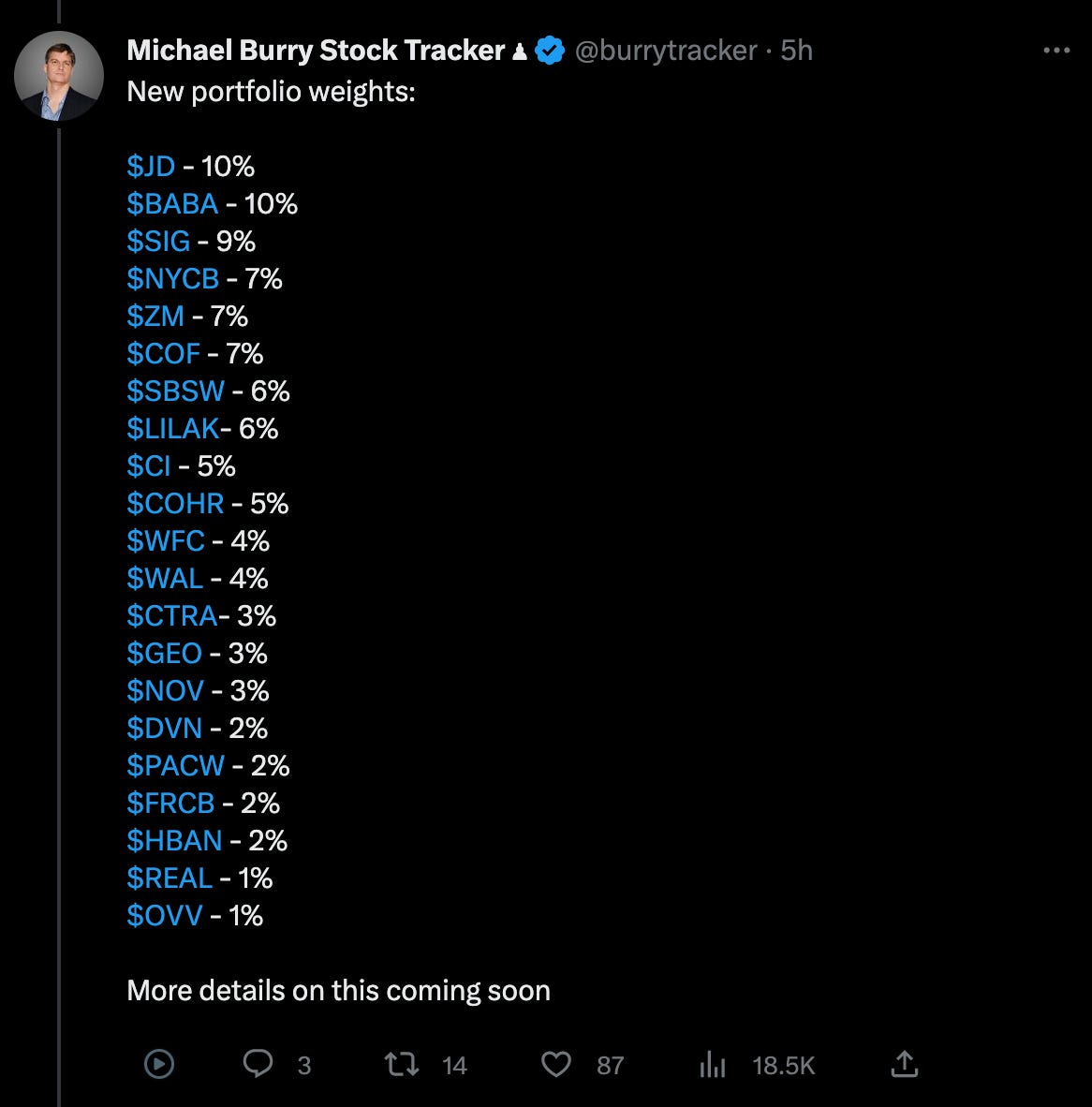

Burry’s current portfolio is weighted as follows:

The two largest companies now happen to be two of the largest Chinese companies on the world. He not only owned these in his past F13 filing, but actually added to his positions this quarter. We wrote up on why he may be bullish on BABA 0.00%↑ about a month ago. Check it out here

He also appears to be long term bullish on the financial sector. He put about $37M of investments behind 9 new banks. Will be interesting to see if he becomes active on Twitter again post F13 filing.

For our paid community get ready for a lot of stock reports. We already have the team diving into his new buys as we speak and are hoping to send two out a week over the next couple months. Also expect write ups on some of Buffett’s new buys too 🤝

For those in our community who are waiting to take the leap to become a paid subscriber, now may be the time 😉

Happy Monday Fam!

When are they coming up with android version? To connect to my brokerage account.

In your reports can you put dates on when Burry has purchased/sold what stock. To report he's purchased in this last quarter can mean 3 months ago. Looking at charts, a lot can happen in those 3 months. It would be good to see when these people actually purchase and sell and see if they make or lose on thier trades. It would also help us subscribers decide if we want to jump in or not. Without the extra information, its just an interesting newsletter that I cant see I'd subscribe to again.