Here's Why Warren Buffett Loves Oil Giant Occidental Petroleum

The Oracle of Omaha

Warren Buffett has been purchasing Occidental Petroleum OXY 0.00%↑ in the open market throughout 2022.

We expect him to continue buying more.

In fact, Buffett could buy out the entire company over the next few years.

Here's why Buffett loves OXY 0.00%↑

Let’s dig in… 👇👇👇

What is $OXY?

OXY is a diversified oil and gas operator with assets across all major energy-producing nations of the world. Assets include an E&P business, a chemicals business, and a midstream business.

Buffett is a hardcore value investor and focuses all of his time on valuation. $OXY has a market cap of $65 billion and an enterprise value of $95 billion. EBITDA over the last 12 months was $20 billion, putting the EV/EBITDA at only 4.5x. This thing is cheap!

In addition to the low valuation multiple, $OXY should continue to generate strong cash flows in future periods. Oil and gas are at multi-year highs and should continue to stay at these levels for years to come. It is a new age in energy where exploration is shunned.

Exploration is shunned as energy companies have been in a recession for a decade. Investors in the energy space have lost billions for over a decade. Mandates across the industry are to return capital and not explore. Lack of exploration will lead to sustained higher prices.

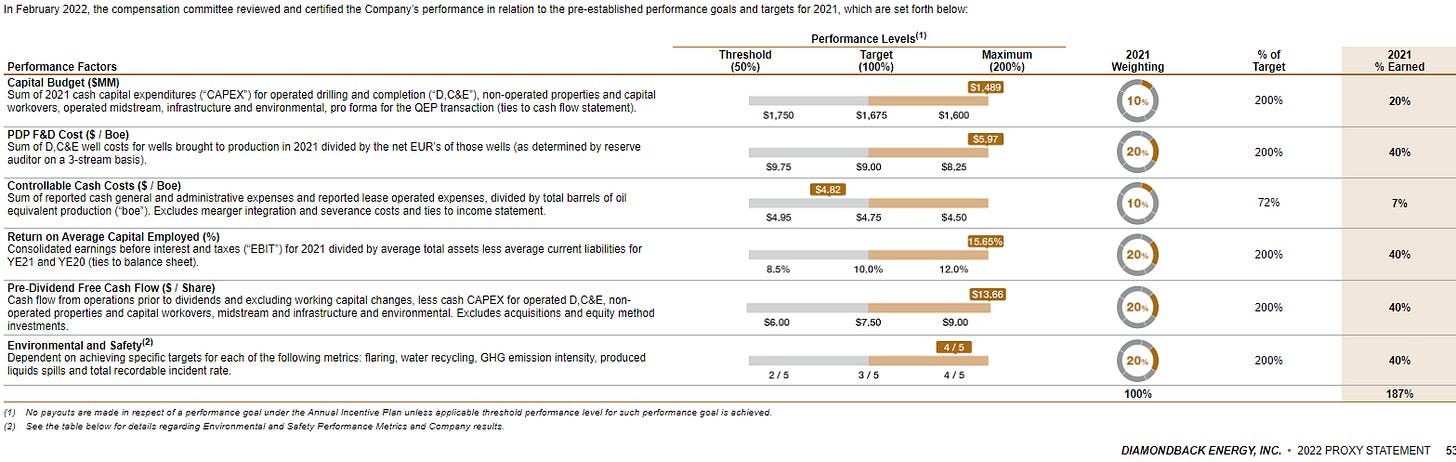

Even better, energy company executive teams are now getting bonuses based on how much capital they return. Remember back to pre-2014, energy executives got bonuses based on how many wells they drilled. 20% of $FANG executive bonuses are based on dividends.

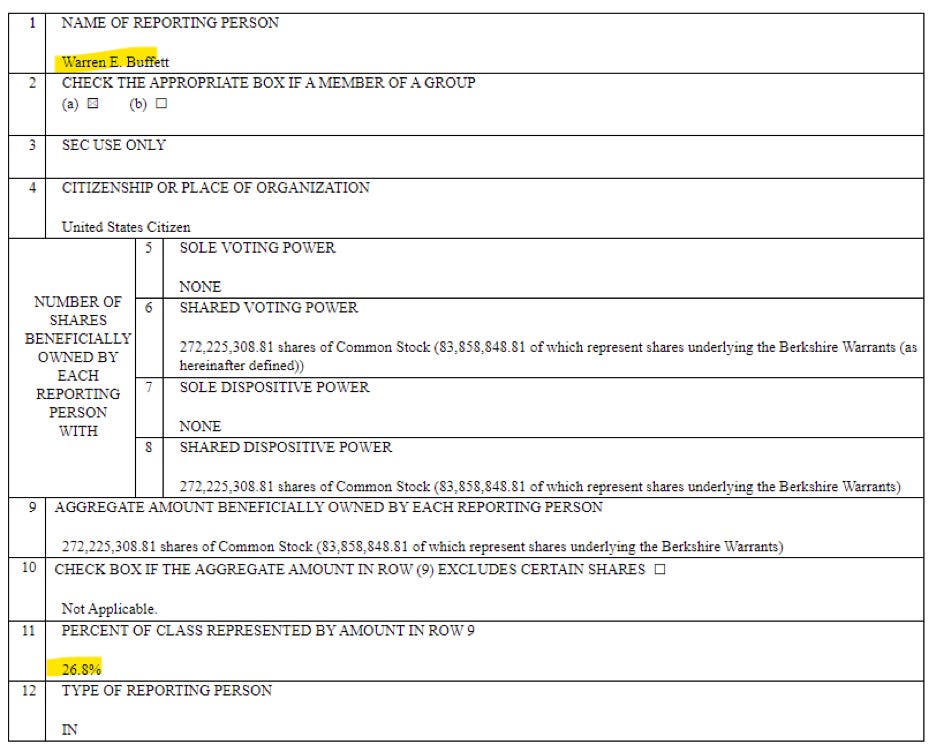

All of this means big profits for companies like $OXY over the medium term. Warren Buffett thinks so too as he now owns over 26.8% of $OXY.

Finally, I think Warren Buffett could buy out $OXY completely. Buffett recently stated this:

"Occidental would work better as a subsidiary of Berkshire than a stock holding given the volatility that exists in the energy/commodity markets.”

If Buffett bought out $OXY it would lower their cost c of capital, allowing $OXY to return even more capital back to Berkshire in the form of dividends and repurchases. Buffett adores dividends.

If Buffett acquires $OXY it would be one of the largest takeovers Berkshire has done. The last big deal Berkshire did was BNSF in 2009 for $44 billion. This would be needle-moving and help Berkshire allocate their $100 billion war chest.

Want to learn more about investing and what stocks Buffett is buying? We will have more posts on some of Buffett’s largest holdings.