Breaking: Pelosi let's her $RBLX shares expire worthless

Total loss of $300K

What a week Pelosi has had in the markets. From selling $8M worth of tech stocks to then learning that the DOJ opened up a lawsuit against one of her port co’s to then this most recent trade, it appears that her trading activity isn’t slowing down any time soon. Below please find the formal trade update brought to you by the Autopilot team 🙌

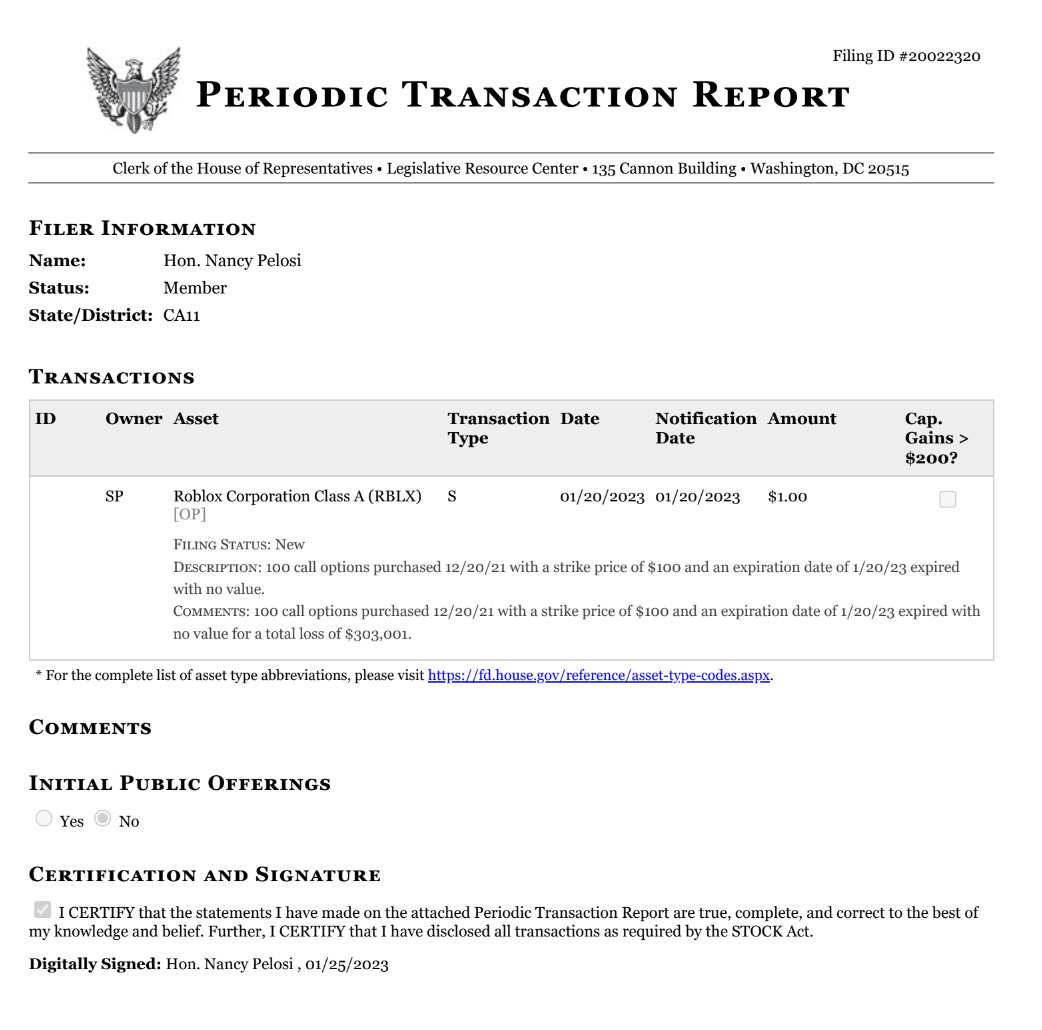

Formal Trade: Let 100 call options with a strike price of $100/share and an expiration date of 1/20/23 expire worthless

Profit/Loss: Loss of $303,001

Timeline of her RBLX 0.00%↑ Trades:

3/10/21 - Bought 10,000 shares totaling ~$650K

12/20/21 - Bought 100 call options with a strike price of $100/share and an expiration date of 1/20/23 totaling ~$300K

12/28/22 - Sold 10,000 shares totaling ~$300K

1/20/23 - Let her 100 call options expire worthless

Source:

RBLX 0.00%↑ Performance:

1 Week: +7.18%

1 Month: +31%

1 Year: -39%

For those who don’t know, Pelosi often implements a very risky trading strategy by buying LEAP options. A LEAP allows an investor who is very bullish on a stock to get the same long term upside with a lower amount of capital. When you hear the term, high risk - high reward, that is what LEAPs are.

In this case, since RBLX 0.00%↑ shares were not above $100/share, her call options expire for $0.00 meaning she lost her entire investment. Like we said, high risk - high reward.

Next week we will write a formal write up on RBLX 0.00%↑ stock and identify is now is a good time to buy the dip. Please consider supporting our movement & subscribing to to the premium subscription to receive the formal report.

Cheers!